SUMMARY

Cryptocurrency mining in 2026 is the process of using powerful computers to solve complex puzzles that secure blockchain networks like Bitcoin. Miners confirm transactions, add them to the blockchain, and earn rewards in coins.

Today, mining relies on advanced ASICs such as the Antminer S21 Hydro and GPUs for altcoins like Monero. While the core process hasn’t changed, mining in 2026 is more competitive, energy-conscious, and regulated, with a growing shift toward renewable power and AI-driven optimization.

What is Cryptocurrency Mining in 2026?

Cryptocurrency mining in 2026 is the process of creating new digital coins and securing blockchain networks by solving complex mathematical problems with powerful computers. Unlike the early days when anyone could mine Bitcoin on a laptop, today’s mining is a highly competitive, industrial-scale operation. Miners now use advanced hardware like ASICs (Application-Specific Integrated Circuits) and GPUs to validate transactions, maintain decentralization, and earn rewards in return.

After Bitcoin’s 2024 halving, mining rewards have dropped to 3.125 BTC per block, making efficiency more important than ever. This means miners must carefully balance electricity costs, hardware investments, and market prices to remain profitable. At the same time, new cryptocurrencies, eco-friendly mining methods, and cloud-based solutions have opened doors for small-scale miners.

How Does Cryptocurrency Mining Actually Work?

Cryptocurrency mining in 2026 may sound complex, but at its core, it’s the process of confirming digital transactions and adding them to a blockchain. Let’s break it down step by step so it’s easier to understand.

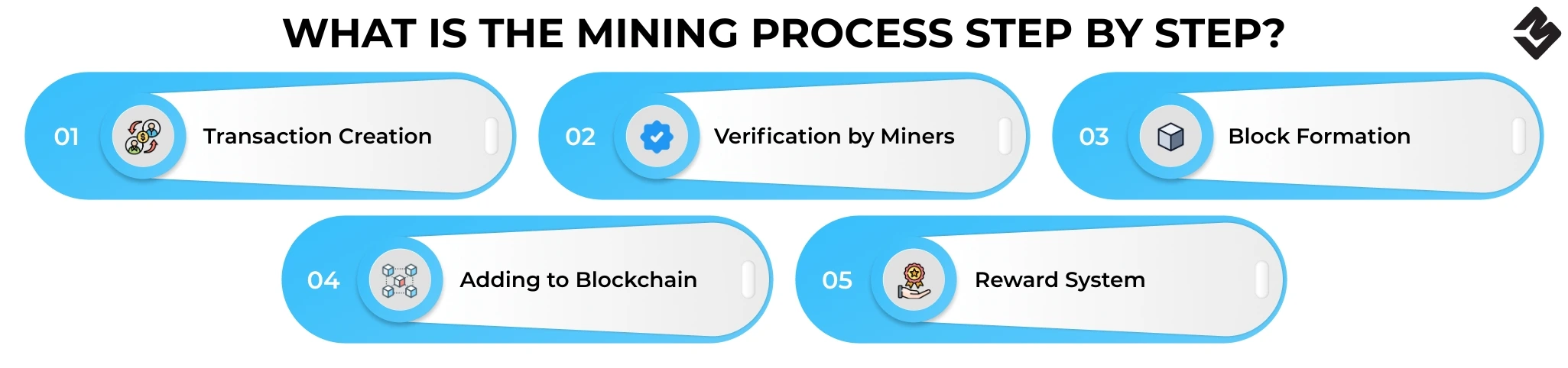

What Is the Mining Process Step by Step?

1. Transaction Creation – When someone sends Bitcoin or another cryptocurrency, that transaction enters a pool of unconfirmed data.

2. Verification by Miners – Mining computers (ASICs or GPUs) compete to validate these transactions by solving complex mathematical puzzles.

3. Block Formation – Once a miner successfully solves the puzzle, verified transactions are grouped into a “block.”

4. Adding to Blockchain – The new block is added permanently to the blockchain, creating a transparent and unchangeable record.

5. Reward System – The miner who solved the puzzle receives a reward, which in Bitcoin’s case is now 3.125 BTC per block (after the 2024 halving).

This system ensures the blockchain remains secure, decentralized, and trustless without relying on banks or central authorities.

What Is Proof-of-Work (PoW) in Mining?

Proof-of-Work (PoW) is the traditional mechanism that powers Bitcoin, Litecoin, Dogecoin, and many other coins.

- How it works: Miners use computing power to solve cryptographic puzzles.

- Why it matters: The difficulty of these puzzles prevents hackers from easily altering transactions.

- Challenges in 2026: PoW requires massive amounts of electricity and specialized hardware, making it less accessible for everyday users.

In short, PoW is secure but energy-intensive.

What Is Proof-of-Stake (PoS) and How Is It Different?

With rising concerns about energy use, Proof-of-Stake (PoS) has gained popularity in recent years. Ethereum, Cardano, and Solana all use PoS.

- How it works: Instead of solving puzzles, validators “stake” their coins as collateral to secure the network.

- Energy benefits: PoS consumes over 99% less energy than PoW.

- Rewards: Validators earn staking rewards, similar to interest, rather than block rewards.

In 2026, PoS is seen as a greener and more scalable solution, while PoW remains the gold standard for security.

Which System Dominates in 2026?

- Bitcoin and Major PoW coins: Still dominate traditional mining.

- PoS networks: Growing rapidly, attracting users who prefer lower costs and eco-friendly validation.

Together, PoW and PoS form the backbone of modern crypto networks, offering different opportunities for miners and investors.

What Are the Different Types of Mining Methods?

In 2026, cryptocurrency mining is not a one-size-fits-all process. Depending on your budget, hardware, and goals, you can choose from several mining methods. Let’s break down the main types so you can see which one fits best.

What Is Solo Mining?

Solo mining means running your own hardware and trying to mine blocks independently.

How it works: A miner uses powerful machines (like ASICs) to solve puzzles alone.

Pros:

- Full block rewards go to the miner.

- Total control over hardware and setup.

Cons:

- Very low chances of solving blocks unless you have massive power.

- High electricity and equipment costs.

In 2026, solo mining is rare and mostly limited to industrial-scale operations with cheap electricity.

What Is Pool Mining?

Pool mining is the most common method today. Multiple miners combine their computing power and share rewards.

How it works: You join a mining pool, contribute your hash power, and earn a share of the rewards.

Pros:

- More consistent payouts.

- Lower risk compared to solo mining.

Cons:

- Pool fees (usually 1-3%).

- Rewards are smaller but frequent.

For home miners and small setups, pool mining is the most practical choice in 2026.

What Is Cloud Mining?

Cloud mining means renting mining power from a third-party company instead of buying your own machines.

How it works: You pay a contract fee, and the provider mines on your behalf.

Pros:

- No need for expensive hardware or electricity.

- Easy to get started online.

Cons:

- High risk of scams and unreliable providers.

- Long-term contracts may not be profitable if coin prices fall.

Cloud mining is only safe if you use trusted providers, but caution is needed because scams are common.

How Do Mining Devices Differ (CPU, GPU, ASIC)?

Mining methods also depend on the type of hardware used:

| Device | Best For | Strengths | Weaknesses |

| CPU | Entry-level mining | Cheap, easy to use | Very low profits in 2026 |

| GPU | Altcoins (ETH-class coins, Ravencoin, etc.) | Flexible, resellable | Less efficient for Bitcoin |

| ASIC | Bitcoin, Litecoin, Dogecoin | Extremely powerful, efficient | Expensive, single-purpose |

Which Mining Method Is Best in 2026?

- Industrial miners: Prefer solo or pool mining with ASICs.

- Home miners: Pool mining with GPUs or small ASICs is more realistic.

- Low-risk beginners: Cloud mining is an option, but only with trustworthy platforms.

By 2026, pool mining with ASICs dominates Bitcoin, while GPU mining remains popular for smaller altcoins.

What Equipment Do You Need for Crypto Mining in 2026?

Mining in 2026 is not about using an old laptop – it requires specialized equipment designed for efficiency and performance. The hardware and supporting tools you choose directly determine whether your mining setup is profitable or just a costly hobby.

What Are the Main Hardware Options?

1. ASIC Miners (Application-Specific Integrated Circuits)

- Purpose-built machines designed for mining one algorithm (e.g., Bitcoin’s SHA-256 or Litecoin’s Scrypt).

- Pros: Extremely efficient, high hashrate.

- Cons: Expensive, cannot be repurposed for other tasks.

- Example (2026 models): Bitmain Antminer S21 Hydro (335 TH/s, 5360W).

2. GPU Miners (Graphics Processing Units)

- Versatile hardware mainly used for altcoins (Monero, Ravencoin, etc.).

- Pros: Flexible, resellable for gaming or AI workloads.

- Cons: Less efficient for Bitcoin.

- Example (2026 models): NVIDIA RTX 5090 GPUs.

3. CPU Mining (Entry-Level)

- Rare in 2026, mainly for hobbyists mining CPU-friendly coins.

- Pros: Low cost, accessible.

- Cons: Extremely low earnings compared to ASICs/GPUs.

What About Electricity and Power Supply?

Mining consumes a lot of energy.

- ASICs: Can draw 3000-6000W each.

- GPUs: Around 200-350W per card.

Key Requirements:

- Stable electricity supply with low cost per kWh (ideally below $0.07).

- High-quality power supply units (PSUs) to prevent overheating.

- Backup power systems (UPS or generators) for large farms.

Without cheap electricity, even the most powerful miner may not turn a profit.

How Important Is Cooling?

Mining rigs generate significant heat. Proper cooling keeps machines efficient and extends their lifespan.

- Air cooling: Fans and ventilation systems for small setups.

- Liquid cooling: More advanced, used in industrial mining farms.

- Immersion cooling: Submerging rigs in special fluids – growing in popularity in 2026.

Comparison Table: Mining Equipment in 2026

| Hardware | Hashrate | Power Usage | Best For | Cost Range (2026) |

| ASIC (Antminer S21 Hydro) | 335 TH/s | 5360W | Bitcoin, Litecoin/Dogecoin | $5,000-$8,000 |

| GPU (RTX 5090) | 250 MH/s | 300W | Altcoins (Monero, Ravencoin) | $1,200-$2,000 |

| CPU (High-end Ryzen/Intel) | 1-2 KH/s | 120W | Niche coins only | <$500 |

In 2026, ASICs dominate Bitcoin and Litecoin/Dogecoin mining, while GPUs are still useful for altcoins. CPUs are largely obsolete for serious mining. But beyond hardware, miners must also budget for electricity, cooling, and maintenance, which together often cost more than the machines themselves.

Is Crypto Mining Still Profitable in 2026?

Yes, crypto mining is still profitable in 2026 – but only under the right conditions. Profitability depends on three major factors: hardware efficiency, electricity costs, and cryptocurrency market prices. Let’s break it down.

How Did the 2024 Bitcoin Halving Affect Mining Rewards?

- Before 2024: Miners earned 6.25 BTC per block.

- After the halving: Rewards dropped to 3.125 BTC per block.

- Impact: Profits were cut in half overnight, forcing miners to upgrade to the latest ASICs or secure cheaper electricity to stay competitive.

In 2026, miners with low-cost electricity (< $0.07/kWh) and efficient hardware (like Antminer S21 Hydro) can mine Bitcoin profitably.

What Are the Main Costs of Mining?

Mining costs are more than just buying a machine. Here’s what to consider:

- Hardware investment – $5,000-$10,000 for modern ASICs.

- Electricity bills – Often the biggest expense, ranging from $100-$500 per month per rig.

- Cooling & maintenance – Fans, air conditioning, or immersion systems.

- Mining pool fees – Usually 1-3% of your rewards.

Profitability Comparison of Mining Methods in 2026

| Mining Method | Hardware Needed | Average Costs (2026) | Electricity Needs | Profitability Level | Best Suited For |

| ASIC Mining | Antminer S21 Hydro | $5,000-$10,000 | 3,000-6,000W | High (if cheap power) | Industrial farms |

| GPU Mining | RTX 5090, RX 7900 XTX | $1,200-$2,500 | 200-350W per GPU | Moderate (altcoins) | Home miners |

| CPU Mining | High-end Ryzen/Intel | <$500 | 100-150W | Low | Hobbyists |

| Cloud Mining | Contract-based (no rigs) | $100-$2,000+ | None (outsourced) | Risky (depends on provider) | Beginners (careful) |

Are Other Coins More Profitable?

Yes, some altcoins are still attractive:

- Litecoin/Dogecoin merged mining – Efficient for ASIC miners.

- Monero (XMR) – Popular for CPU/GPU mining due to ASIC resistance.

- Ravencoin – Rising coins mined with GPUs in 2026.

These offer smaller but more consistent profits for home miners.

So, Is It Worth Mining in 2026?

- Big industrial miners: Yes, if they run large-scale farms with cheap renewable or hydroelectric energy.

- Home miners: Only if they choose altcoins, run energy-efficient setups, or mine as a hobby rather than a full-time business.

In 2026, Bitcoin mining is a break-even or slim-profit game for most, but altcoins and energy-efficient setups still offer opportunities for smaller miners.

What Are the Environmental Impacts of Mining Cryptocurrency in 2026?

In 2026, cryptocurrency mining causes large energy use, significant carbon emissions, heavy water use, air pollution, and a growing problem of electronic waste. These effects hurt the environment unless mining uses clean energy and better technology.

Energy Use & Carbon Emissions

- The Bitcoin network in 2026 uses around 173 terawatt-hours (TWh) of electricity per year.

- Over 50% (≈ 54%) of that energy now comes from renewable sources (solar, wind, hydro) globally.

- Despite renewables, mining still emits a lot of CO₂. Bitcoin alone is responsible for about 106.6 million metric tons of CO₂ annually.

- Cryptocurrency mining globally was estimated to emit ~139 million tonnes CO₂-eq in 2026.

Water Use & Other Natural Resources

- Mining uses lots of water: for cooling machines and maintaining the facilities. For example, fresh water consumption by Bitcoin mining is about 3,011 gigaliters in 2026.

- In previous years (2023), cryptocurrency mining consumed ~1,859 million cubic meters of water.

Air Pollution & Health Risks

- In the U.S., mining increases air pollution, especially fine particulate matter (PM₂.₅), which is linked to diseases like asthma, heart disease, and lung problems.

- Each Bitcoin transaction in 2026 produces about 712 kilograms of CO₂. That’s very high; comparable to many thousands of average credit-card transactions.

Electronic Waste & Lifecycle Impacts

- Mining uses specialized hardware (ASICs) that often becomes obsolete quickly when new, more powerful machines enter the market.

- The environmental cost of manufacturing mining equipment (production phase) can contribute up to 80% of total lifecycle impacts, especially if usage is powered with dirty energy.

Mitigation: Green Mining & Cleaner Energy Options

- More miners are switching to renewable power; over half of Bitcoin mining energy in 2026 comes from clean sources.

- Some regions with surplus hydroelectric power, like parts of Canada or Norway, are now more attractive for mining because they can lower emissions.

While mining still has large environmental costs – high electricity use, carbon emissions, water consumption, air pollution, e-waste – 2026 shows signs of improvement: growing renewable usage, awareness of lifecycle impacts, and location shifts. The worst damage happens when power comes from coal or fossil fuels, and equipment is inefficient or replaced often.

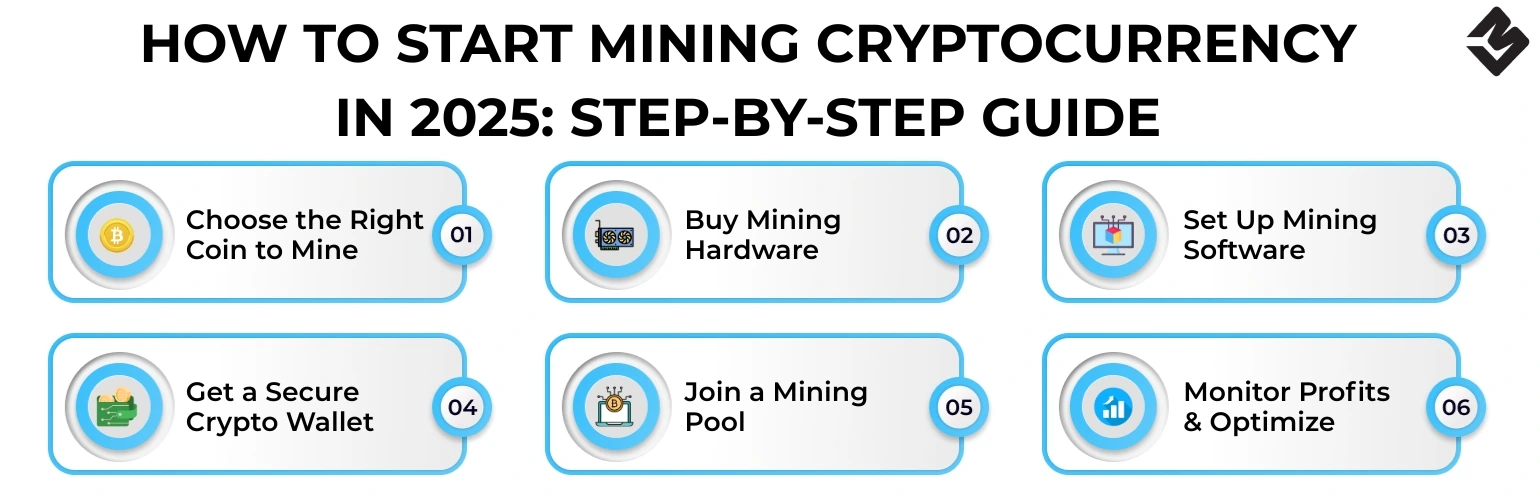

How to Start Mining Cryptocurrency in 2026: Step-by-Step Guide

To start mining in 2026, you need three things: the right hardware (ASIC or GPU), mining software, and a crypto wallet. Then you either mine solo or join a mining pool, and finally, you monitor profits using dashboards or apps. The process is simple but requires planning, upfront costs, and electricity management.

Step 1: Choose the Right Coin to Mine

Not all cryptocurrencies can be mined. In 2026:

- Bitcoin (BTC): Needs powerful ASICs; only profitable at scale.

- Litecoin (LTC) + Dogecoin (DOGE): Can be mined together via merged mining with ASICs like Antminer L11 Pro.

- Monero (XMR): ASIC-resistant, mined with CPUs/GPUs – better for home miners.

- Ravencoin (RVN): Popular GPU-mined coins with strong communities.

Step 2: Buy Mining Hardware

Updated 2026 mining hardware options:

ASICs for Bitcoin & Litecoin/Dogecoin

- Bitmain Antminer S21 Hydro: 335 TH/s, 20 J/TH – one of the most efficient in 2026.

- Bitmain Antminer L11 Pro: Good entry-level ASIC for merged mining DOGE/LTC.

GPUs for Altcoins

- NVIDIA RTX 4090 & AMD RX 7900 XTX: Still leading for GPU mining coins like Ravencoin.

- FPGA-based rigs are emerging but still niche in 2026.

Tip: Always calculate ROI with electricity cost before buying.

Step 3: Set Up Mining Software

Once you have hardware:

Popular Mining Software in 2026:

- NiceHash (easy for beginners, supports many coins).

- HiveOS (professional monitoring, supports multiple rigs).

- XMRig (specialized for Monero).

Configuration involves:

- Downloading the software.

- Enter your wallet address.

- Choosing a mining pool (if not solo mining).

Step 4: Get a Secure Crypto Wallet

You need a wallet to receive rewards:

- Hardware Wallets (Ledger Nano X, Trezor Model T) – Best for long-term safety.

- Software Wallets (Exodus, Trust Wallet) – Easy to use, good for small amounts.

- Always enable 2FA and cold storage for maximum security.

Step 5: Join a Mining Pool

Mining solo in 2026 is difficult because competition is high. Mining pools allow many miners to combine power and share rewards.

- Top Pools in 2026: Foundry USA, AntPool, ViaBTC, F2Pool.

- For Altcoins: 2Miners and HeroMiners are popular.

- Pools charge 1%-3% fees but give more consistent payouts.

Step 6: Monitor Profits & Optimize

Use online calculators like Mining Now or NiceHash Profitability Calculator to track daily earnings. Monitor:

- Hashrate

- Power usage

- Mining difficulty

- Market prices

Some miners now use AI-powered optimization software to auto-switch to the most profitable coin in real time.

What Are the Risks and Challenges of Crypto Mining in 2026?

In 2026, the biggest risks of crypto mining are regulatory uncertainty, rising electricity costs, market volatility, scams, and hardware issues. Mining can still be profitable, but these challenges mean miners must plan carefully and manage risks.

1. Regulatory Risks

- Global Crackdowns: Countries like China still ban Bitcoin mining, while the U.S. and EU are increasing rules on energy usage and tax reporting.

- Carbon Taxes: Some regions now charge extra fees for high-carbon mining operations, making fossil-fuel mining less profitable.

- Licensing Requirements: In 2026, Kazakhstan, Canada, and some U.S. states require registration or licenses to run large-scale mining farms.

Risk: Sudden law changes could force miners to shut down or relocate.

2. Energy & Cost Challenges

- Electricity is the biggest expense for miners.

- In 2026, global average electricity prices range from $0.05/kWh in cheap-energy regions (like Paraguay, Ethiopia) to $0.20+/kWh in developed nations.

- Rising energy demand and climate policies are pushing prices higher, reducing profit margins.

- High-performance ASICs like the Antminer S21 Hydro are efficient, but still consume thousands of watts per machine.

Risk: If Bitcoin’s price drops but energy costs stay high, mining becomes unprofitable.

3. Market Volatility

- Bitcoin and Altcoin prices remain unpredictable.

- Example: In early 2026, Bitcoin briefly fell 20% in one week, causing many small miners to shut down.

- Difficulty adjustments also play a role: when more miners join, rewards per machine decrease.

Risk: Profitability can swing daily, making long-term planning difficult.

4. Scams & Security Issues

- Cloud Mining Scams: Many fake websites promise guaranteed profits but disappear with investor money.

- Hacking Risks: Mining pools and software can be targeted by hackers, stealing payouts.

- Phishing Attacks: Miners are tricked into giving away wallet keys or installing malware.

Rule: Never trust “too good to be true” offers – always use verified pools and wallets.

5. Hardware & Maintenance Risks

- High Costs: Modern ASICs can cost $3,000-$10,000 per unit in 2026.

- Obsolescence: Newer models are released every 12-18 months, making old ones unprofitable.

- Heat & Noise: Mining rigs produce extreme heat, requiring cooling systems that add extra cost.

- Repairs: ASICs are sensitive-power surges, dust, or overheating can shorten their lifespan.

Future of Cryptocurrency Mining: What’s Next?

The future of crypto mining in 2026 and beyond is heading toward AI-driven optimization, greener energy solutions, advanced hardware like hydro-cooled ASICs, and more global regulation. Mining will continue, but it will look very different – more professional, more sustainable, and less accessible to casual hobbyists.

1. AI and Automation in Mining

Artificial intelligence is reshaping how mining works:

- Profit Switching: AI-powered software can automatically switch to the most profitable coin based on market prices, difficulty, and electricity rates.

- Smart Cooling Systems: Machine learning tools adjust fan speeds, liquid cooling, or immersion systems to reduce energy waste.

- Fault Detection: AI can predict hardware failure before it happens, lowering downtime and repair costs.

By 2026, most large-scale farms are expected to use AI to optimize every step of mining.

2. Sustainable Energy & Green Mining

Environmental concerns are pushing the industry toward cleaner energy:

- Renewable Power Growth: In 2026, over 54% of Bitcoin mining already uses renewable energy (hydro, solar, wind, nuclear). This percentage is rising as governments push carbon neutrality.

- Hydro-Cooling ASICs: Devices like the Antminer S21 Hydro use water cooling, which is more energy-efficient and lowers environmental impact compared to air cooling.

- Waste Heat Reuse: Some miners now redirect excess heat from mining rigs to warm greenhouses, office buildings, or homes.

Future mining operations will likely rely almost fully on renewable and recycled energy sources.

3. Hardware Innovations

Mining hardware is evolving quickly:

- More Efficient ASICs: Each generation delivers higher hashrates with lower joules per terahash (J/TH).

- Immersion Cooling Systems: Expected to become mainstream by 2026, allowing rigs to last longer with less noise and dust damage.

- Hybrid Mining Setups: Some farms combine ASICs for Bitcoin with GPUs for altcoins, balancing profitability and flexibility.

4. Regulations & Decentralization Trends

Governments are paying closer attention:

- Carbon Reporting: Some countries now require miners to disclose energy sources and emissions.

- Tax Rules: Mining income must be declared, and stricter audits are being introduced.

- Decentralization Push: Smaller coins like Monero continue to resist ASIC dominance, keeping GPU miners relevant.

5. Long-Term Outlook

- Bitcoin’s next halving in 2028 will cut block rewards again, forcing miners to rely more on transaction fees.

- Mining will keep shifting to regions with cheap, clean power like Canada, Paraguay, and the Middle East.

- AI + sustainability will define mining’s survival, as inefficient rigs and dirty energy become unprofitable.

The future of crypto mining is greener, smarter, and more professional. Small hobby mining may shrink, but industrial farms using AI-driven tools, renewable power, and efficient hardware like the Antminer S21 Hydro will continue to dominate.

CONCLUSION

Crypto mining in 2026 is still alive and profitable, but it’s not for everyone. Success depends on cheap electricity, efficient hardware, and a smart strategy. Industrial-scale miners using advanced machines like the Antminer S21 Hydro in regions with renewable power enjoy strong returns. Meanwhile, home miners may find better opportunities in GPU-friendly coins like Monero rather than chasing Bitcoin.

The biggest challenges today are energy costs, regulations, and hardware upgrades, which can quickly turn profits into losses. At the same time, mining is moving toward sustainability, AI-driven optimization, and global decentralization, making it more professional and eco-friendly than before.

If you’re considering mining, start small, research carefully, and always calculate your costs versus rewards. For many beginners, simply buying and holding Bitcoin may be easier. But for those ready to invest wisely, mining can still be a valuable part of the crypto journey.

Check out the latest ASIC Miners

FAQs ON CRYPTO MINING

-

How long does it take to mine cryptocurrencies?

The time varies depending on factors like the mining algorithm, the mining network’s computational power, and your ASIC’s quality. For example, Bitcoin mining time is around 10 minutes, whereas Litecoin mining time is around 2 minutes.

-

How much does it cost to mine 1 Bitcoin in 2026?

Mining 1 Bitcoin in 2026 costs between $30,000 and $45,000 depending on electricity rates and hardware efficiency. At Bitcoin prices above $60,000, there’s room for profit, but only if electricity costs are low.

-

Is Bitcoin mining still profitable in 2026?

Yes, Bitcoin mining in 2026 can still be profitable, but mainly for industrial-scale miners using efficient ASICs like the Antminer S21 Hydro and cheap electricity below $0.07/kWh. Small home miners usually only break even unless they mine altcoins or join mining pools.

-

What is the best cryptocurrency to mine in 2026?

~ Bitcoin (BTC): Most profitable for large farms with ASICs.

~ Litecoin + Dogecoin: Good for merged mining with ASICs like Antminer L11 Pro.

~ Monero (XMR): Popular for GPU/CPU miners at home. -

Can you mine cryptocurrency at home in 2026?

Yes, but it’s tough. ASICs are loud, hot, and power-hungry, so home setups often focus on GPU mining altcoins (Kaspa, Monero, Ravencoin). Some beginners use cloud mining contracts, but those come with risks.

-

What are the biggest risks of crypto mining in 2026?

~ High electricity bills cutting into profits.

~ Sudden regulation changes (carbon taxes, mining bans).

~ Hardware obsolescence every 12-18 months.

~ Scams from cloud mining and wallet hacks. -

How much electricity does Bitcoin mining use in 2026?

The Bitcoin network consumes about 173 TWh annually, similar to Argentina’s electricity use. Around 54% of this power now comes from renewable sources like hydro, wind, and solar.

-

Should I mine crypto or buy Bitcoin directly in 2026?

If you have access to cheap renewable energy and modern ASICs, mining can be worthwhile. For most beginners, however, buying and holding Bitcoin directly is safer and usually more cost-effective.

Han su

Han Su is a Technical Analyst at CryptoMinerBros, a leading provider of cryptocurrency mining hardware. He has over 5 years of experience in the cryptocurrency industry, and is an expert in mining hardware, software, and profitability analysis.

Han is responsible for the technical analysis and research on ASIC Mining at Crypto Miner Bros. He also writes In-depth blogs on ASIC mining and cryptocurrency mining, and he has a deep understanding of the technology. His blogs are informative and engaging, and they have helped thousands of people learn about cryptocurrency mining.

He is always looking for new ways to educate people about cryptocurrency, and he is excited to see how the technology continues to develop in the years to come.

In his spare time, Han enjoys hiking, camping, and spending time with his family. He is also an avid reader, and he loves to learn about new things.