SUMMARY

Is Bitcoin Mining Still Profitable in 2026?

Yes, Bitcoin mining in 2026 remains profitable but requires a smart strategy.

Large-scale miners with advanced ASICs and cheap electricity still see strong returns, especially with Bitcoin and merged Litecoin/Dogecoin mining.

Home miners can join in through ASIC-resistant coins like Monero, Ravencoin, and Vertcoin, though profits are smaller. Electricity costs, hardware efficiency, and crypto price swings greatly influence earnings.

Eco-friendly energy sources like solar, hydro, and geothermal make mining more sustainable and cost-effective.

Quick Comparison Table: Profitable Coins to Mine in 2026

Let’s take a quick look at some of the best coins to mine. Not every coin is the same when it comes to profitability. Some are great for industrial setups, while others are more suited for smaller-scale, home mining.

By looking at the table, you can quickly get an idea of what’s worth mining based on the hardware you have and how much you’re willing to spend. Let’s dig a little deeper into which coins might work best for your setup.

| Coin | Algorithm | Block Reward | Hardware Needed | Mining Difficulty | Profitability Potential |

| Bitcoin (BTC) | SHA-256 | 3.125 BTC | ASIC only | Very High | Profitable with cheap power + top ASICs |

| Monero (XMR) | RandomX | 0.6 XMR | CPU / GPU | Moderate | Good for home miners, ASIC-resistant |

| Litecoin (LTC) | Scrypt | 6.25 LTC | ASIC (Scrypt) | High | Solid profits when merged with DOGE |

| Dogecoin (DOGE) | Scrypt (merged with LTC) | 10,000 DOGE | ASIC (Scrypt) | High | Best via merged mining with Litecoin |

| Zcash (ZEC) | Equihash | 2.5 ZEC | GPU / ASIC | Moderate | Profitable with efficient GPUs |

| Dash (DASH) | X11 | 1.56 DASH | ASIC (X11) | High | Niche profitability, needs cheap power |

| Ravencoin (RVN) | KawPoW | 5,000 RVN | GPU | Moderate | GPU-friendly, good for small setups |

| Ethereum Classic (ETC) | Etchash | 2.56 ETC | GPU / ASIC | High | Still viable for GPU miners |

| Kaspa (KAS) | kHeavyHash | 55 KAS | ASIC | High | Strong with ASICs; GPU margins shrinking |

| Aleo (ALEO) | ZK-SNARKs | Aleo variable | ASIC | Moderate | Early stage; ASICs exist, profitability depends on network adoption |

- Best for Industrial Miners → Bitcoin (BTC), Litecoin + Dogecoin (merged mining)

- Best for Home/Small Miners → Monero (XMR), Ravencoin (RVN), Vertcoin (VTC)

- Balanced Options → Ethereum Classic (ETC), Zcash (ZEC)

- Niche/Experimental → Dash (DASH), Aleo (ALEO)

This table sets the stage for the next section, where we’ll dive coin-by-coin into profitability, hardware choices, and ROI expectations.

Coin-by-Coin Profitability Breakdown

Let’s break it down coin by coin. Bitcoin’s still the big player, but it’s tough for smaller miners to get in on the action. On the other hand, coins like Monero or Ravencoin are great for home miners.

Each coin has its own mining requirements, hardware needs, and rewards, so knowing the ins and outs will help you decide which one to go for. Let’s take a closer look at each coin and see how you can make the most out of mining them.

1. Bitcoin (BTC)

Bitcoin crypto remains the king of mining, but is also the most competitive. In 2026, mining BTC will only be advantageous when you have an industrial-quality ASIC and affordable power.

- Algorithm: SHA-256

- Block Reward (post-April 2024 halving): 3.125 BTC

- Block Time: ~10 minutes

- Current Price (20-Sept 2025): ~$115,000-$125,000 per BTC

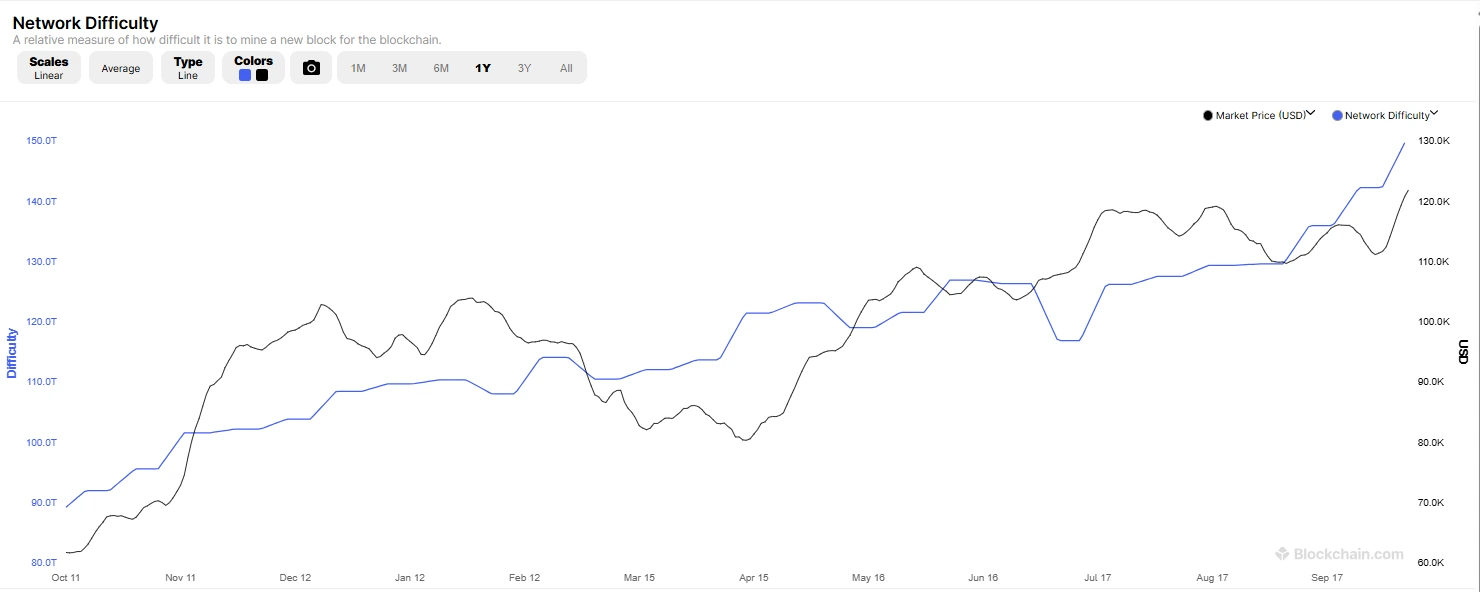

- Network Difficulty: ~142 trillion (record highs)

Source: Blockchain.com

Hardware Needed:

Bitcoin can only be mined profitably using ASIC miners. Modern top models include:

- Bitmain Antminer S21 XP Hydro (~473 TH/s at 5,676W)

- WhatsMiner M60 series (~360 TH/s at 6,900W)

Older ASICs (like Antminer S19 or WhatsMiner M30) are now close to break-even or unprofitable in regions with average power costs.

Profitability Example:

Let’s assume:

- Machine: Antminer S21 XP Hydro (473 TH/s, 5,676W)

- Electricity Cost: $0.05 / kWh

- BTC Price: $115,000

- Daily Revenue ≈ $23-27

- Daily Electricity Cost ≈ $6.81

- Net Profit ≈ $16-20 per day per machine

At higher power costs (e.g., $0.12 / kWh), profits shrink drastically and may even go negative.

2. Monero (XMR)

Monero is the top CPU/GPU-minable coin in 2026, popular among privacy enthusiasts. Its RandomX algorithm is ASIC-resistant, keeping the playing field open for small miners.

- Algorithm: RandomX

- Block Reward: ~0.6 XMR

- Block Time: ~2 minutes

- Price (Sept 2025): ~$160-$180 per XMR

- Difficulty: Moderate, ASIC-resistant

Hardware Needed:

- High-end CPUs (e.g., AMD Ryzen 9, Threadripper)

- GPUs (NVIDIA RTX 3000/4000 series, AMD RX 6000/7000 series)

Profitability Example (CPU Mining):

- CPU: AMD Ryzen 9 7950X (~40,000 H/s, 200W)

- Electricity: $0.12 / kWh

- Daily Revenue ≈ $0.70-0.90

- Daily Cost ≈ $0.60

- Net Profit ≈ $0.10-0.30 per day

Profitability Example (GPU Mining):

- GPU: RTX 4080 (~2,500 H/s, 250W)

- Revenue ≈ $0.30-0.40/day

- Cost ≈ $0.20/day

- Net Profit ≈ $0.10-0.20/day

3. Litecoin (LTC)

Litecoin is one of the oldest Bitcoin alternatives and remains profitable because of merged mining with Dogecoin.

- Algorithm: Scrypt

- Block Reward: 6.25 LTC

- Block Time: ~2.5 minutes

- Price (20-Sept 2025): ~$85-$95 per LTC

Hardware Needed:

- Scrypt ASICs (e.g., VolcMiner D1 Mini Pre, Goldshell Mini Doge III for small-scale)

Profitability Example:

- VolcMiner D1 Mini Pre (~2.2 GH/s, 500W)

- Electricity: $0.05 / kWh

- Daily Revenue (LTC + DOGE merged mining) ≈ $3.44-$3.85

- Daily Cost ≈ $0.60

- Net Profit ≈ $2.84-$3.25/day

4. Dogecoin (DOGE)

Dogecoin cannot be mined directly anymore – instead, it’s mined alongside Litecoin via merged mining.

- Algorithm: Scrypt (merged with LTC)

- Block Reward: 10,000 DOGE

- Block Time: ~1 minute

- Price (20-Sept 2025): ~$0.21-0.28 DOGE

Hardware Needed:

- Scrypt ASICs (e.g., Bitmain Antminer L9, ElphaPex DG Home 1 for small-scale)

Profitability Example:

- Antminer L9 (~16 GH/s, 3360W)

- Electricity: $0.05 / kWh

- Daily Revenue (LTC + DOGE merged mining) ≈ $25-28

- Daily Cost ≈ $4.03

- Net Profit ≈ $20.97-$23.97/day

5. Zcash (ZEC)

Zcash is a privacy-centric cryptocurrency that uses the Equihash algorithm. It can be recovered with a GPU and special ASICs, which makes it versatile for separate miners.

- Algorithm: Equihash

- Block Reward: 2.5 ZEC

- Block Time: ~75 seconds

- Price (20-Sept 2025): ~$35-40 per ZEC

Hardware Needed:

- GPUs (NVIDIA RTX 3070/4070, AMD RX 6800 XT)

- ASICs (Bitmain Antminer Z15 Pro, ~840KSol/s at 2780W)

Profitability Example (Antminer Z15 Pro):

- Revenue ≈ $10.9-$12.4/day

- Power Cost ≈ $8.00/day (at $0.12/kWh)

- Net Profit ≈ $2.9-$4.4/day

6. Dash (DASH)

Dash was once popular for fast transactions, but has recently lost ground. However, it still has a dedicated mining community using X11 ASICs.

- Algorithm: X11

- Block Reward: 1.56 DASH

- Block Time: ~2.5 minutes

- Price (20-Sept 2025): ~$28-32 per DASH

Hardware Needed:

- ASIC miners (e.g., Antminer D9 ~1.7 TH/s at 2,836W)

Profitability Example (Antminer D9):

- Revenue ≈ $3.00-3.50/day

- Power Cost ≈ $2.00/day

- Net Profit ≈ $1.00-1.50/day

7. Ravencoin (RVN)

Ravencoin is designed for asset transfers and uses an ASIC-resistant algorithm, making it a favorite among GPU miners.

- Algorithm: KawPoW

- Block Reward: 5,000 RVN

- Block Time: ~1 minute

- Price (20-Sept 2025): ~$0.015-0.02 per RVN

Hardware Needed:

- GPUs (RTX 3070, 3080, 4080, AMD RX 6800)

Profitability Example (RTX 3070):

- Hashrate: ~16 MH/s at 125W

- Revenue ≈ $0.25-0.35/day

- Cost ≈ $0.15/day

- Net Profit ≈ $0.10-0.20/day

8. Ethereum Classic (ETC)

Ethereum Classic continues as the main Ethash-based Proof-of-Work chain after Ethereum’s move to Proof-of-Stake. It remains one of the strongest GPU/ASIC-mineable coins.

- Algorithm: Etchash (variant of Ethash)

- Block Reward: 2.56 ETC

- Block Time: ~13 seconds

- Price (20-Sept 2025): ~$25-30 per ETC

Hardware Needed:

- ASICs (e.g., iPollo V2H 3400 Mh/s 475W); high-end GPUs secondary

Profitability Example (iPollo V2H):

- Hashrate: 3400 MH/s at 475 W

- Electricity Cost: $0.06 / kWh

- Daily Revenue: ≈ $2.0-$2.7

- Daily Electricity Cost: ≈ $0.68

- Net Profit: ≈ $1.3-$2.0 per day per machine

9. Kaspa (KAS)

Kaspa is a blockDAG Layer-1 that uses kHeavyHash with ~1-second blocks; ASICs now dominate profitability.

- Algorithm: kHeavyHash

- Block Reward: ~55 KAS (decreases monthly)

- Block Time: ~1 second

- Price (20-Sept 2025): ~$0.07-0.09 per KAS

Hardware Needed:

- ASICs (e.g., Iceriver KS7 Lite, IceRiver KS-series)

Profitability Example (Iceriver KS7 Lite):

- Hashrate: 4.2Th/s at 500W

- Revenue ≈ $0.80-0.90/day

- Cost ≈ $0.72/day (@ $0.06/kWh)

- Net Profit ≈ $0.10-0.20/day

10. Aleo (ALEO)

Aleo is a privacy L1 using zkSNARK-based Proof-of-Succinct-Work; rewards are variable “credits.”

- Algorithm: PoSW (zkSNARK)

- Block Reward: Variable credits (not fixed per block)

- Block Time: ~12 seconds

- Price (20-Sept 2025): ~varies by market (use pool/exchange quote)

Hardware Needed:

- ASICs (Goldshell AE Max II 540Mh/s 3200W; other AE-series)

Profitability Example (Goldshell AE Max II):

- Hashrate: 540Mh/s at 3200W

- Revenue ≈ $6.61-10.61/day

- Cost ≈ $4.61/day (@$0.06/kWh)

- Net Profit ≈ $2-6/day

Mining Hardware in 2026: ASIC vs GPU vs CPU

Whether you’re using an ASIC, a GPU, or a CPU, each type of hardware comes with its pros and cons. If you’re serious about mining Bitcoin, you’ll need an ASIC. But if you want to mine altcoins like Ethereum Classic or Ravencoin, a GPU might be a better fit.

Let’s take a look at how these different types of hardware stack up, so you can make the best choice for your mining operation.

- ASIC miners (Application-Specific Integrated Circuits)

- GPUs (Graphics Processing Units)

- CPUs (Central Processing Units)

Each method has strengths and weaknesses; Your choice depends on whether you want to give a mine to the coins to Bitcoin, Altcoins, or Privacy.

ASIC Mining (Industrial Grade)

ASICs are specialized machines built for a single algorithm (e.g., SHA-256 for Bitcoin, Scrypt for Litecoin/Dogecoin). They are by far the most efficient hardware, but also the most expensive and power-hungry.

Pros:

- Highest efficiency (hashrate per watt)

- Essential for Bitcoin and Scrypt coins

- Quick ROI if electricity is cheap

Cons:

- Expensive upfront ($3,000-$10,000 per unit)

- Zero flexibility – only mines one algorithm

- Generates significant heat and noise

Best ASIC Models in 2026:

- Bitcoin: Bitmain Antminer S21 XP Hydro (~473 TH/s, 5,676W)

- Litecoin/Dogecoin: Bitmain Antminer L9 (~16 GH/s, 3,360W)

- Ethereum Classic: iPollo V2H (~3400 Mh/s, 475W)

- Dash: Antminer D9 (~1.7 TH/s, 2,836W)

- Zcash: Antminer Z15 Pro (~840 KSol/s, 2,780W)

GPU Mining (Flexible and Popular for Altcoins)

GPUs remain the backbone of altcoin mining, especially for coins like Ravencoin, Zcash, and Vertcoin. They are less efficient than ASICs but more flexible since they can mine multiple coins.

Pros:

- Versatile (mine many coins)

- Widely available (NVIDIA/AMD cards)

- Resale value if mining becomes unprofitable

Cons:

- Less efficient than ASICs

- ROI depends heavily on coin price

- Still requires careful tuning for profitability.

Best GPU Models in 2026:

- NVIDIA RTX 4080 / 4090 → High hashrate, substantial resale value

- NVIDIA RTX 3070 / 3080 → Best price-to-performance balance

- AMD RX 6800 / 6900 XT → Efficient for Ravencoin

CPU Mining (Entry-Level and Niche)

CPUs are the least powerful but remain useful for coins that resist ASIC/GPU dominance, like Monero (XMR).

Pros:

- Accessible – most people already have a CPU

- Suitable for Monero’s RandomX algorithm

- Low upfront cost

Cons:

- Very low profitability

- Limited coin options

- High electricity costs relative to earnings

Best CPUs in 2026 for Mining:

- AMD Ryzen 9 7950X

- AMD Threadripper series

- Intel i9-13900K

Hardware Cost, Efficiency, ROI Comparison

| Hardware | Cost (2026) | Power Efficiency | Best Coins | ROI Timeline |

| ASICs | $3,000-$10,000+ | Very High | Bitcoin, Litecoin, Dogecoin, Aleo, Kaspa | 8-18 months (cheap power) |

| GPUs | $400-$1,500 each | Moderate | ETC, RVN, VTC, ZEC | 12-24 months |

| CPUs | $300-$1,000 | Low | Monero (XMR) | 18-36 months |

- If you want to mine Bitcoin or top-tier coins, ASICs are non-negotiable.

- If you want flexibility and lower entry costs, GPUs are your best bet.

- If you want to casually participate or mine privacy coins, CPUs work – but don’t expect major profits.

How to Calculate Mining Profitability

If you’re thinking about mining, you probably want to know if it’s going to make you money, right? Well, calculating profitability isn’t as complicated as it sounds. You just need to look at a few key things: your hardware’s hashrate, the block reward, and of course, electricity costs. We’ll walk through some simple examples to show you how to figure out if your mining operation is worth it. Let’s do the math so you don’t have to guess!

The Profitability Formula

At its simplest, profitability can be calculated using this formula:

For live numbers, check the Mining Now real-time miner profitability dashboard.

Daily Profit=(Hashrate Contribution×Block Reward×Coin Price)−Electricity Cost

Breaking it down:

1. Hashrate Contribution → How much mining power your machine adds to the network.

Example: Antminer S21 XP Hydro = 473 TH/s on SHA-256.

2. Block Reward → The number of coins miners earn for solving one block.

Bitcoin = 3.125 BTC (after April 2024 halving).

3. Coin Price → Market price of the cryptocurrency.

As of 20-Sept 2025, BTC ≈ $115,000.

4. Electricity Cost → Power consumption (Watts) × Hours (24) × kWh rate.

Example 1: Bitcoin Mining (ASIC)

- Hardware: Antminer S21 XP Hydro (473 TH/s, 5,676W)

- BTC Price: $115,000

- Block Reward: 3.125 BTC

- Electricity: $0.05/kWh

Step 1: Daily Revenue

The S21 XP Hydro earns ~0.000226 BTC/day.

- 0.000226 × 115,000 = $25.99 per day

Step 2: Daily Power Cost

- 5,676W × 24h = 136.22kWh/day

- 136.22 × $0.05 = $6.81/day

Step 3: Net Profit

- $25.99 − $6.81 = $19.18 per day

Monthly ≈ $575 profit

Yearly ≈ $6,985 profit

Example 2: Monero Mining (CPU)

- Hardware: AMD Ryzen 9 7950X (~40,000 H/s at 200W)

- XMR Price: $170

- Electricity: $0.12/kWh

Step 1: Daily Revenue

Ryzen 9 7950X earns ~0.0045 XMR/day.

- 0.0045×170=$0.77/day

Step 2: Daily Power Cost

- 200W×24h=4.8 kWh

- 4.8×0.12=$0.58/day

Step 3: Net Profit

- $0.77−$0.58=$0.19/day

Monthly ≈ $5.70 profit

Yearly ≈ $69 profit

Example 3: Litecoin + Dogecoin (Merged Mining)

- Hardware: Bitmain Antminer L9 (16 Gh/s, 3,360 W)

- LTC Price: $115.15

- DOGE Price: $0.28

- Electricity: $0.06/kWh

Step 1: Daily Revenue

- ≈ 0.0201 LTC ($2.31) + ~98 DOGE ($27.44) = $29.75/day

Step 2: Daily Power Cost

- 3360W × 24h = 80.64 kWh/day

- 80.64 × $0.06 = $4.84/day

Step 3: Net Profit

- $29.75 − $4.84 = $24.91/day

Monthly ≈ $747

Yearly ≈ $9,080

Why This Matters

Without these calculations, it’s easy to assume that higher hashrate always equals higher profits. But as we see:

- A top-tier ASIC can generate thousands annually.

- A CPU miner might only cover electricity costs.

Merged mining (LTC + DOGE) often delivers better ROI than mining just one coin.

Step-by-Step Setup Guides

Getting started with mining can seem a little overwhelming, but don’t worry – it’s easier than you think! In this section, we’ll walk you through the step-by-step process of setting up your mining rig.

Whether you’re planning to mine Bitcoin, Monero, or Litecoin and Dogecoin through merged mining, we’ve got you covered.

Want to see it in action? Explore real mining setups and tutorials on the Crypto Miner Bros YouTube channel.

From picking the right hardware to configuring your miner, we’ll make sure you know exactly what to do to get started.

1. How to Mine Bitcoin (BTC)

Bitcoin mining in 2026 is only feasible with ASIC hardware. Here’s how to get started:

Step 1: Buy ASIC Hardware

- Recommended: Antminer S21 Hydro or WhatsMiner M60 series.

- Budget per machine: $3,500-$6,000.

Step 2: Secure Cheap Power & Cooling

- Aim for electricity below $0.08/kWh.

- Consider immersion cooling or hydro units for efficiency.

Step 3: Choose a Mining Pool

- Popular pools in 2026: Foundry USA, Antpool, F2Pool.

- Pool fees range from 1% to 2.5%.

Step 4: Connect & Configure

- Connect the ASIC to the internet + power supply.

- Access the miner dashboard via local IP.

- Enter pool address + Bitcoin wallet address.

Step 5: Start Mining

- Monitor hashrate, temperature, and fan speeds.

- Withdraw mined BTC directly to your wallet.

2. How to Mine Monero (XMR)

Monero is a favorite for home miners since it can be mined on CPUs and GPUs.

Step 1: Choose Hardware

- CPU: AMD Ryzen 9 7950X or Threadripper.

- GPU: RTX 3080/4080 or AMD RX 6800.

Step 2: Download Mining Software

- Recommended: XMRig (open-source, widely used).

Step 3: Choose a Mining Pool

- Popular pools: MineXMR, SupportXMR, MoneroOcean.

Step 4: Configure Miner

- Edit the config.json file in XMRig.

- Add pool address + wallet address.

- Example: pool.supportxmr.com:3333.

Step 5: Start Mining

- Run XMRig → terminal displays hashrate.

- Adjust CPU threads or GPU intensity for stability.

3. How to Mine Dogecoin + Litecoin (Merged Mining)

Dogecoin is no longer mined directly – instead, it’s mined alongside Litecoin through merged mining, maximizing profits.

Step 1: Buy a Scrypt ASIC Miner

- Recommended: Antminer L9 (~16 GH/s).

- Budget: $5,000-$7,000 per unit.

Step 2: Download Mining Software / Use ASIC Dashboard

- Most ASICs have built-in firmware for pool connection.

Step 3: Choose a Mining Pool

- Pools supporting merged mining: LitecoinPool.org, ProHashing, Antpool.

Step 4: Configure Miner

- Enter pool stratum URL + your Litecoin wallet address.

- Since Dogecoin is merged, rewards automatically include DOGE.

Step 5: Start Mining

- Monitor ASIC via the dashboard.

- Collect LTC + DOGE rewards directly in your wallet.

Setup Summary

- Bitcoin → Needs top ASICs + cheap power, industrial scale.

- Monero → Best for home miners using CPU/GPU.

- Litecoin + Dogecoin → Profitable combo via merged mining on Scrypt ASICs.

Mining Pools vs Solo Mining

Now, here’s something you’ll need to think about: Solo Mining vs Pool Mining – which is better for you? Solo mining used to be the way to go, but with how difficult mining has gotten, most miners join a pool to combine their power and share rewards.

But there are still pros and cons to each approach, and depending on what you’re after, one might work better for you than the other. Let’s talk about the differences and see which option makes the most sense for your mining goals.

Before choosing your setup, read our detailed Best Crypto Mining Pools guide to find the most trusted and profitable pools for 2026

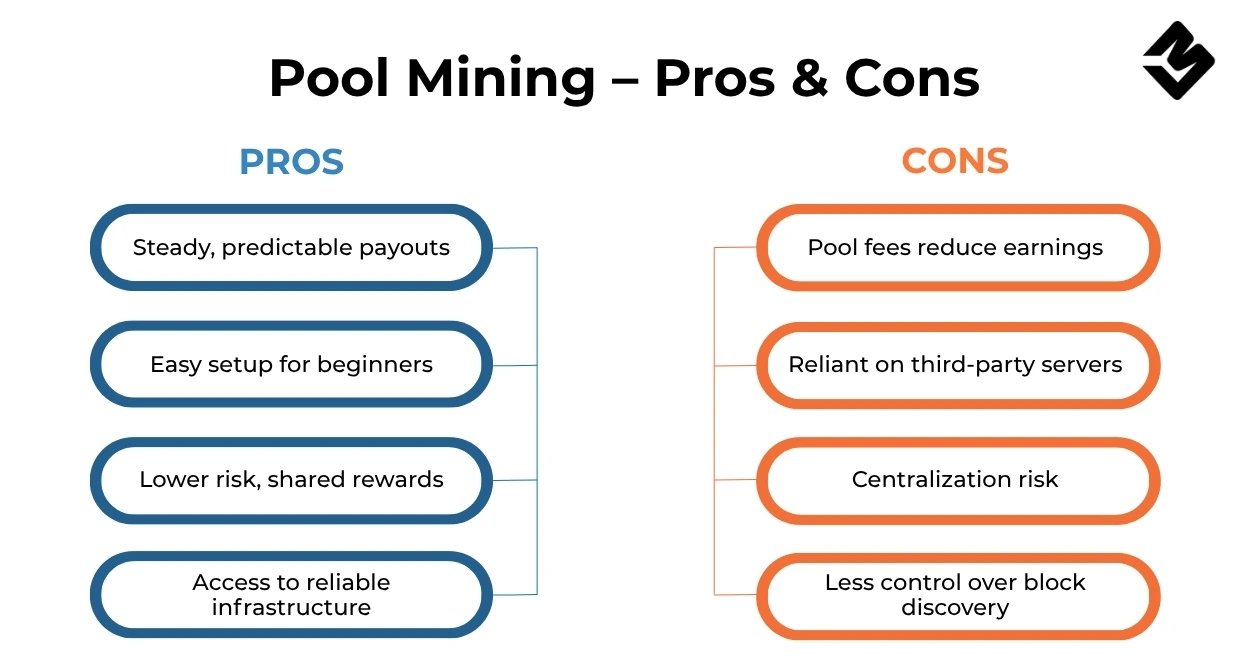

Mining Pools

How it Works:

- Multiple miners contribute hashrate to a shared pool.

- Rewards are distributed based on each miner’s share of work.

- Pools usually charge a 1%-2.5% fee.

Pros:

- More consistent earnings (steady payouts).

- Lower variance compared to solo mining.

- Beginner-friendly – no need to wait for rare block wins.

Cons:

- Pool fees cut into profits.

- Dependence on third-party operators.

- Large pools raise centralization concerns.

Best Pools in 2026:

- Bitcoin (BTC): Foundry USA, Antpool, F2Pool

- Monero (XMR): SupportXMR, MoneroOcean, MineXMR

- Litecoin/Dogecoin (LTC/DOGE): LitecoinPool.org, ProHashing

- Ethereum Classic (ETC): Ethermine, 2Miners

- Ravencoin (RVN): Flypool, HeroMiners

Solo Mining

How it Works:

- Miner runs their own node and attempts to solve blocks independently.

- If successful, it keeps the entire block reward.

Pros:

- No pool fees (100% rewards are yours).

- Complete control over the mining operation.

- Appeals to decentralization advocates.

Cons:

- Extremely high variance (may take months/years to solve one block).

- Practically impossible for BTC mining without massive hashrate.

- High technical setup and maintenance requirements.

Which Should You Choose?

- Bitcoin miners: Always join a pool – solo mining is virtually impossible without industrial-scale farms.

- Altcoin miners (Monero, Ravencoin, Vertcoin): Pools are best, but solo mining is possible for small networks with low difficulty.

- Hybrid approach: Some miners occasionally solo mine smaller coins for a shot at full block rewards while relying on pool mining for steady income.

Should You Mine at Home or Use a Professional Farm in 2026?

Now that you know a bit about mining, let’s talk about where you should mine. Should you set up your rig at home or go big with a professional farm? Home mining is great for learning the ropes or if you’re just in it for fun, but the big bucks come from large ASIC mining farms with tons of ASICs and cheap electricity. We’ll break down the pros and cons of both so you can decide what’s best for your situation.

In 2026, the mining landscape has split into two worlds:

- Home miners who run CPUs, GPUs, or small ASICs for learning, hobby, or side income.

- Professional farms that deploy thousands of ASICs in warehouses powered by cheap electricity contracts.

Let’s break it down.

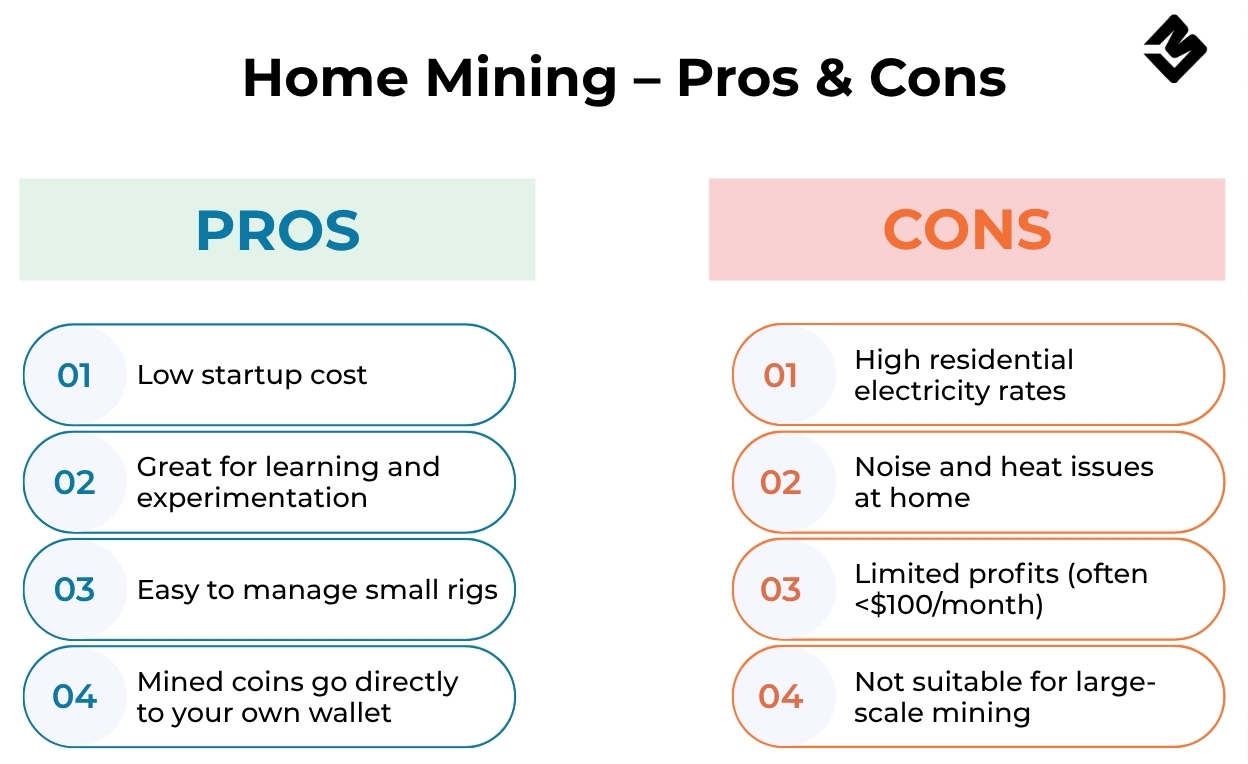

Mining at Home

What It Looks Like:

- A few GPUs or CPUs running in a personal rig.

- Small ASICs (like a NerdMiner NerdQaxe++ or low-wattage BTC ASIC).

- Mining software on a regular PC connected to a pool.

Pros:

- Low entry cost (start with $500-$2,000).

- Easy to learn and experiment with.

- Less risk if market conditions change.

- Ideal for ASIC-resistant coins (Monero, Ravencoin, Vertcoin).

Cons:

- High electricity costs (residential rates $0.10-$0.25/kWh).

- Heat and noise issues in living spaces.

- Limited earnings (often <$100/month).

Best Coins for Home Mining in 2026:

- Monero (XMR) – CPU-friendly, ASIC-resistant.

- Ravencoin (RVN) – GPU mining coin.

- Dogecoin/Litecoin – ASIC-resistant and suitable for hobbyists.

Home mining = excellent for learning, bad for big profits.

Professional Mining Farms

What It Looks Like:

- Hundreds or thousands of ASIC miners are housed in containers or warehouses.

- Industrial-scale cooling systems (immersion, hydro, or air).

- Electricity contracts as low as $0.02-$0.05/kWh.

Pros:

- Massive scale → higher efficiency and profits.

- Lower electricity costs.

- Professional management + optimized cooling.

- Access to top-tier ASICs.

Cons:

- Requires millions in capital investment.

- Regulatory risks (governments targeting large mining centers).

- High maintenance (hardware failures, cooling issues).

- Dependent on crypto price cycles.

Best Coins for Professional Farms in 2026:

- Bitcoin (BTC) is the top choice for industrial mining.

- Litecoin + Dogecoin (merged mining) – second most popular.

- Ethereum Classic (ETC) – large GPU farms.

Professional farms = high risk and reward, but not accessible to beginners without serious capital.

Key Differences

| Factor | Home Mining | Professional Farms |

| Startup Cost | $500-$5,000 | $1M-$50M+ |

| Power Costs | $0.10-$0.25/kWh | $0.02-$0.05/kWh |

| Scale | 1-10 rigs | 1,000+ rigs |

| Profit Potential | $20-$300/month | $100K-$10M/year |

| Best Coins | Monero, RVN, VTC | BTC, LTC/DOGE, ETC |

- If you’re just starting out or want to learn → Go with home mining using a CPU/GPU-friendly coin.

- If you’re aiming for serious income → Only possible with professional ASIC farms and access to cheap electricity.

Sustainable and Eco-Friendly Mining

The energy consumption of mining has been a hot topic, and it’s no different in 2026. But here’s the good news: more miners are turning to eco-friendly solutions, like solar, wind, and hydropower, to make their operations greener and more cost-effective.

In this section, we’ll explore how green mining is not only better for the planet but also more profitable in the long run. Let’s take a look at how renewable energy is changing the game for miners.

1. Renewable Energy in Mining

Many professional mining farms now operate using:

- Hydropower → Cheap, abundant in regions like Sichuan (China), Quebec (Canada), and parts of Scandinavia.

- Solar Power → Popular in sunny regions (Texas, Spain, the Middle East).

- Wind Energy → Used in the U.S. Midwest and Northern Europe.

- Geothermal → Iceland and El Salvador lead the way with 100% geothermal Bitcoin mining.

2. Energy Efficiency Strategies

Modern miners use advanced methods to reduce waste and maximize output:

- Immersion Cooling → Submerging ASICs in special liquid to cut heat and extend hardware life.

- Hydro-Cooled ASICs → Models like Antminer S21 XP Hydro run cooler and more efficiently.

- Smart Mining Software → Dynamically adjusts power usage based on electricity prices.

- Heat Recycling → Miners use excess heat to warm homes, greenhouses, or industrial processes.

3. Carbon Footprint Reduction

- Some mining companies buy carbon credits to offset emissions.

- Governments incentivize eco-mining farms with tax breaks and grants.

- “Green mining tokens” (projects like KlimaDAO) reward miners who prove renewable energy use.

4. Why Eco-Friendly Mining Matters

- Lower Costs → Renewable energy = cheaper long-term operations.

- Regulatory Compliance → Many countries now restrict fossil-fuel-powered mining.

- Public Image → Investors prefer eco-friendly miners, especially institutions.

Case Study: Texas Solar Farms

- Texas has become a global hub for sustainable mining.

- Miners use excess renewable energy that would otherwise be wasted.

- When power demand spikes (heat waves), miners shut down temporarily and are paid by grid operators for releasing energy.

- This “flexible mining” model creates a win-win: stable profits + eco-friendly practices.

Eco-friendly mining isn’t just good for the planet – it’s now the most profitable way to mine due to lower energy costs and favorable regulations.

Common Mistakes and Risks

Mining isn’t all sunshine and profits – there are plenty of mistakes you can make along the way. From underestimating electricity costs to buying outdated hardware, there are many traps that can eat into your profits.

But don’t worry! In this section, we’ll talk about the most common mistakes and how to avoid them. With a little bit of preparation and some smart choices, you can stay on track and make mining work for you.

1. Underestimating Electricity Costs

- Biggest mistake: Thinking revenue = profit.

- High electricity bills can erase earnings.

- Example: A miner making $10/day in revenue could lose money if power costs are $12/day.

Tip: Always calculate profitability with your local kWh rate before buying hardware.

2. Buying the Wrong Hardware

- Some newcomers buy outdated ASICs (like Antminer S9) or weak GPUs.

- These machines can’t compete with modern hardware.

- ROI becomes impossible because difficulty rises faster than earnings.

Tip: Check the hashrate-to-watt ratio (efficiency) before buying. In 2026, the best BTC ASICs run below 20 J/TH.

3. Ignoring Regulation

- Countries like China and Kazakhstan cracked down on mining in recent years.

- Some regions ban crypto mining outright due to energy shortages.

- Mining illegally risks equipment seizures and fines.

Tip: Always check local mining laws and whether mining is allowed in your region.

4. Overestimating Future Coin Prices

- Many miners assume “BTC will always go up” → risky mindset.

- If prices crash, ROI could stretch from 1 year to 3+ years.

- Example: A $5,000 ASIC may never pay itself off if BTC drops below break-even.

Tip: Run worst-case scenario models before investing.

5. Poor Cooling and Maintenance

- ASICs generate massive heat. Without cooling, they fail quickly.

- Dust, overheating, or inadequate airflow → lower hashrates + hardware damage.

Tip: Invest in proper ventilation or immersion cooling.

6. Falling for Cloud Mining Scams

- Many platforms promise “guaranteed daily returns” → most are scams.

- Even legit cloud mining contracts rarely outperform self-mining.

Tip: Avoid cloud mining unless using reputable, transparent providers.

7. Not Joining a Pool

- Solo mining Bitcoin in 2026 is basically impossible.

- Without a pool, your chances of finding a block = almost zero.

Tip: Always use trusted pools for consistent payouts.

Mining is profitable only if you avoid common traps. The most significant risks come from high electricity costs, bad hardware, scams, and poor planning. Smart miners do the math, buy efficient gear, and follow regulations.

Best Mining Software in 2026

Now, let’s talk about the software you’ll need to run it. The right mining software is essential to making your rig work efficiently. If you’re mining Bitcoin, Monero, or altcoins, there are a ton of mining software options out there.

In this section, we’ll highlight some of the best software for 2026, so you can get your rig up and running smoothly.

1. Bitcoin (BTC) – ASIC Mining Software

Bitcoin miners use firmware designed for ASICs.

Top Options:

- BrainOS+ → Open-source, efficient firmware for Antminer models. Boosts the hashrate and improves efficiency.

- VNish → Custom ASIC firmware with tuning and monitoring features.

- CGMiner → Classic mining software, supports ASICs but requires manual setup.

Best Choice in 2026: BraiinOS+ for its efficiency and free upgrades.

2. Monero (XMR) – CPU/GPU Mining

Monero is mined with the RandomX algorithm and optimized for CPUs.

Top Options:

- XMRig → Most popular, easy to configure, works on Windows/Linux.

- SRBMiner → Supports both CPU and GPU mining.

- MoneroOcean Auto-Switcher → Automatically mines the most profitable RandomX coin.

Best Choice in 2026: XMRig – stable, fast, open-source.

3. Litecoin + Dogecoin (Merged Mining – Scrypt)

These coins are mined together with Scrypt ASICs.

Top Options:

- EasyMiner → Beginner-friendly, supports merged mining.

- CGMiner (Scrypt version) → Lightweight, works with pools.

- ASIC Dashboard Firmware → Built-in software on Antminer L11 Pro and other modern ASICs.

Best Choice in 2026: Use the built-in firmware on modern Scrypt ASICs.

4. Ethereum Classic (ETC) – GPU Mining

ETC runs on Etchash (Ethereum’s old algorithm).

Top Options:

- lolMiner → Great for AMD GPUs.

- T-Rex Miner → Optimized for NVIDIA GPUs.

- TeamRedMiner → AMD-focused, efficient tuning.

Best Choice in 2026: lolMiner (AMD) or T-Rex Miner (NVIDIA).

5. Ravencoin (RVN) – GPU Mining

Ravencoin uses KawPoW, designed for GPUs.

Top Options:

- NBMiner → Works well for NVIDIA GPUs.

- T-Rex Miner → Top performance for NVIDIA cards.

- GMiner → Flexible, supports multiple algorithms.

6. Zcash, Vertcoin, and Others

- Zcash (ZEC) → Best with EWBF’s CUDA Zcash Miner.

- Vertcoin (VTC) → Uses One-Click Miner (OCM) – simple for beginners.

- Grin (GRIN) → Supports Gminer for Cuckoo Cycle.

7. Monitoring & Management Tools

Pro miners don’t just run mining software – they also use monitoring dashboards to optimize uptime.

- HiveOS → Manages large GPU/ASIC farms and supports overclocking.

- Excellent Miner → Windows-based management for multiple rigs.

- Minerstat → Cloud-based monitoring for ASICs and GPUs.

Best Choice in 2026: HiveOS for big farms, Minerstat for cloud-based management.

- Beginners: Use One-Click Miner (Vertcoin) or XMRig (Monero).

- Intermediate: Stick with ASIC dashboards or lolMiner/T-Rex for GPUs.

- Professionals: Run HiveOS + BraiinOS for maximum efficiency.

CONCLUSION

So, is Bitcoin mining still worth it in 2026? Yes, but it’s not as easy as it used to be. To make a real profit, you need to have the right hardware, a good strategy, and a solid understanding of your costs.

If you’re mining Bitcoin with an ASIC or trying out some altcoins at home with a GPU, there are still opportunities out there. It’s just about making the right choices, doing the math, and staying on top of the latest trends.

If you’re new to mining, start small, and if you’re ready to invest, go big – either way, with the right approach, mining can still be a worthwhile venture.

Here’s the big picture:

- Bitcoin mining is still highly profitable for industrial-scale farms with access to cheap electricity and the latest ASICs. You’ll struggle to make an ROI if your power costs are high.

- Altcoins like Monero, Ravencoin, and Vertcoin remain the best entry points for home miners, especially those who want to learn or experiment without spending thousands.

- Litecoin + Dogecoin merged mining is a firm middle ground – profitable with modern Scrypt ASICs, especially in regions with affordable energy.

- Sustainability is the future. Miners using solar, wind, hydro, or geothermal energy are more eco-friendly and enjoy lower operating costs.

- Volatile prices, rising difficulty, scams, and regulations remain risks. Successful miners in 2026 will do careful math before investing, keep up with hardware upgrades, and adapt to market changes.

Mining in 2026 is not dead, but it’s no longer the “get-rich-quick” opportunity it once was. It’s a business; like any business, profitability depends on cost control, efficiency, and strategy.

If you’re a beginner, start small with a GPU or CPU-friendly coin to learn the ropes. If you’re ready to invest big, use efficient ASICs and renewable energy contracts. Either way, mining can still be worth it – if you play smart.

Check out the latest Bitcoin Miners

FAQs on Bitcoin Mining Profitability

-

Is Bitcoin mining still profitable in 2026?

Yes, Bitcoin mining can still be profitable in 2026. Large-scale miners with cheap electricity and efficient ASICs see the best returns, while home miners may find smaller profits through altcoins like Monero, Ravencoin, or Vertcoin.

-

How much does it cost to mine 1 Bitcoin in 2026?

On average, mining 1 BTC in 2026 costs between $35,000-$50,000 depending on electricity rates, hardware efficiency, and cooling costs. Industrial farms with renewable energy achieve the lowest costs.

-

What is the best ASIC miner in 2026?

The Bitmain Antminer S21 Hydro and Whatsminer M60 series are among the top-performing ASICs in 2026, offering 300-400 TH/s at high energy efficiency.

-

Can I still mine Bitcoin at home?

Yes, but home mining Bitcoin directly is rarely profitable due to high electricity costs and competition. Instead, home miners often join mining pools or focus on ASIC-resistant coins like Monero (XMR) or Ravencoin (RVN).

-

Which is more profitable in 2026: Bitcoin or altcoin mining?

For industrial setups, Bitcoin remains the most profitable. For home miners, altcoins like Monero, Vertcoin, and Ravencoin are often easier and cheaper to mine, though profits are smaller.

-

How long does it take to mine 1 Bitcoin in 2026?

A single modern ASIC can take over 7 years to mine 1 BTC on its own. That’s why miners usually join pools, where they combine computing power and receive smaller, steady payouts.

-

Is mining better than just buying Bitcoin in 2026?

It depends on your situation. If you have access to cheap electricity and efficient hardware, mining can yield higher returns. Otherwise, for most individuals, simply buying and holding BTC is more cost-effective.

Han su

Han Su is a technical analyst at CryptoMinerBros, a leading provider of cryptocurrency mining hardware. He has over 5 years of experience in the cryptocurrency industry and is an expert in mining hardware, software, and profitability analysis.

Han is responsible for the technical analysis and research on ASIC Mining at Crypto Miner Bros. He also writes in-depth blogs on ASIC mining and cryptocurrency mining, and he has a deep understanding of the technology. His blogs are informative and engaging, and they have helped thousands of people learn about cryptocurrency mining.

He is always looking for new ways to educate people about cryptocurrency, and he is excited to see how the technology continues to develop in the years to come.

In spare time, Han enjoys hiking, camping, and spending time with his family. He is also an avid reader, and he loves to learn about new things.