SUMMARY

Bitdeer Technologies (NASDAQ: BTDR) has had a standout year in Bitcoin mining.While much of the industry spent 2025 tightening budgets after April’s halving, Bitdeer went the other way – scaling up fast, leaning on in-house hardware, and locking in low-cost renewable power.

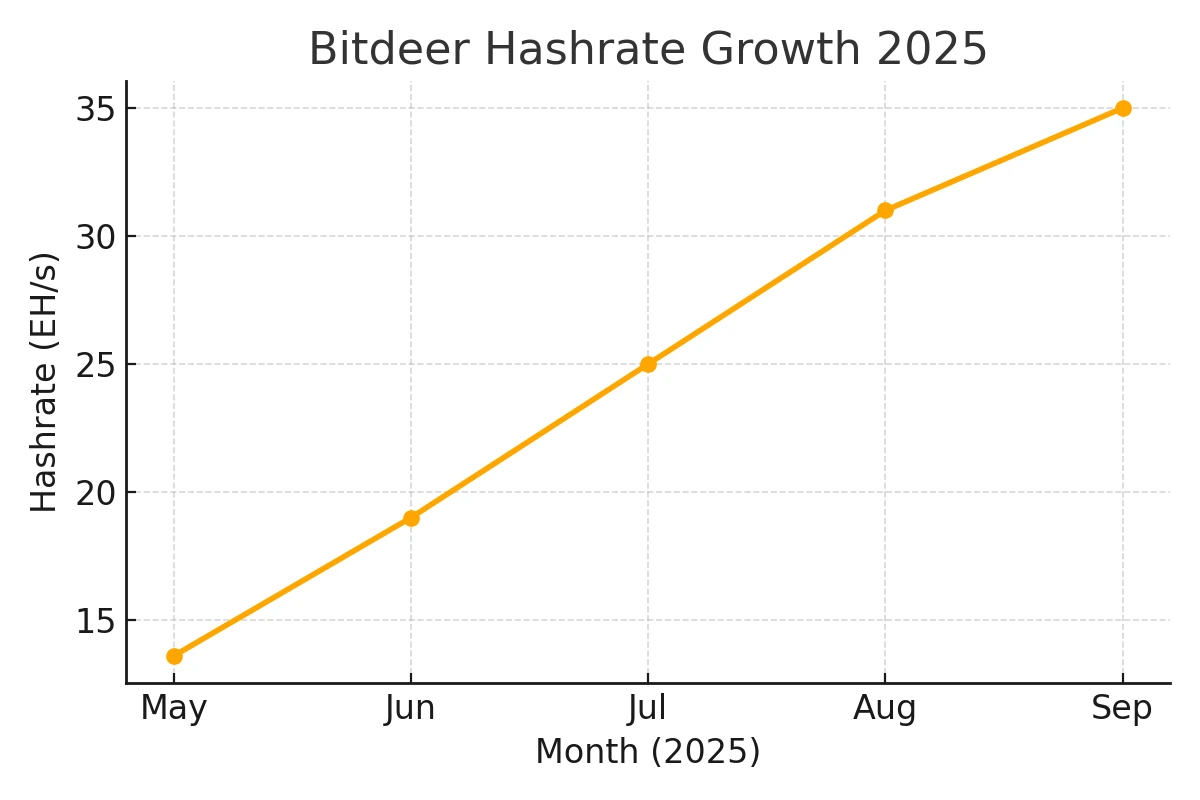

From May to September, the company’s self-mining hashrate jumped from 13.6 EH/s to 35 EH/s, and management says the next milestone – 40 EH/s – is just weeks away. That growth puts Bitdeer firmly among the world’s top industrial miners, according to its September 2025 Production and Operations Update.

Operational Growth and Hashrate Expansion

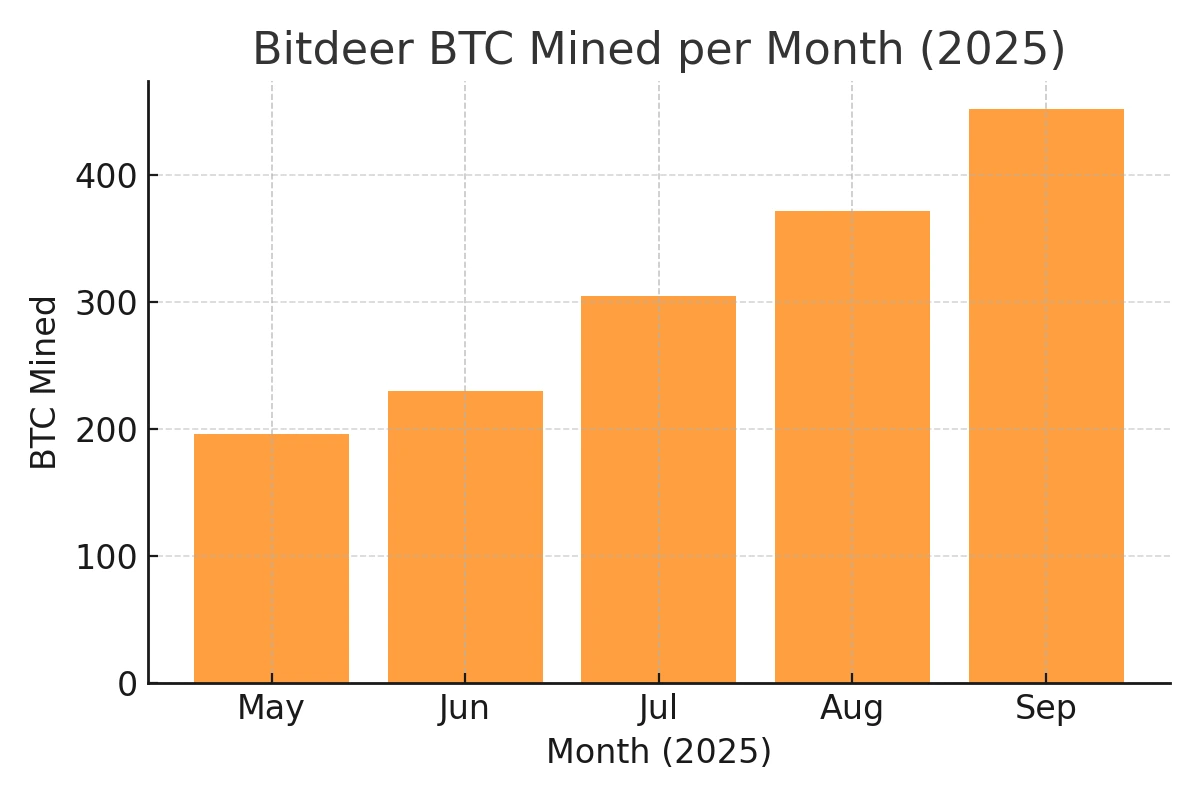

The steady rise in hashrate has been matched by consistent production gains. Bitdeer mined 196 BTC in May, then ramped up to 452 BTC in September as new rigs came online and additional megawatts were energized across its global sites, as detailed in the August and September 2025 updates.

The company’s proprietary mining fleet – all machines it owns and operates directly – is the main reason behind this acceleration. Unlike miners who lease or host rigs, Bitdeer’s strategy centers on full vertical control: it builds the machines, powers the sites, and runs the operations.

That approach gives it agility. Every EH/s added comes from new capacity Bitdeer actually controls, not third-party hardware.

If the trend holds, Bitdeer could cross the 40 EH/s mark by the end of Q4 – a pace of expansion that outperforms most listed competitors.

Infrastructure and Energy Efficiency

Behind the numbers sits one of the most ambitious energy footprints in Bitcoin mining. Bitdeer now operates more than 1.57 GW of online electrical capacity across seven sites in the U.S., Norway, and Bhutan – with another 1.4 GW under construction, according to its September report.

The Rockdale, Texas facility alone accounts for 563 MW and recently completed a 100 MW hydro-cooling conversion to boost thermal efficiency. In Norway, Bitdeer’s campuses tap into low-carbon hydro power and cold air for natural cooling. Bhutan, meanwhile, offers a rare combination of cheap hydroelectricity and stable climate – an ideal setup for dense mining clusters.

Across the portfolio, the company’s average energy cost hovers near $0.045 /kWh, giving it one of the lowest operating baselines in the public mining sector. That cost advantage becomes critical when difficulty climbs or Bitcoin prices soften.

Hardware Built In-House

A major reason Bitdeer can scale this quickly is that it doesn’t rely on other manufacturers. Its SEALMINER A3 series – officially launched in September 2025 – is designed, built, and deployed internally.

The top-end A3 Pro model delivers up to 660 TH/s at 12.5 J/TH, rivaling the Antminer S21 Pro. By manufacturing its own rigs, Bitdeer can upgrade faster and avoid the long lead times that slow down most miners. The company expects its overall fleet efficiency to drop from roughly 14 J/TH to 12.5 J/TH once the rollout is complete in early 2026.

Financial and Operational Metrics

At 35 EH/s and 14 J/TH, Bitdeer’s active fleet draws about 490 MW of power. At $0.045 per kWh, daily energy expense is roughly $530 000. With about 450 BTC mined each month and Bitcoin averaging ≈ $114 000 in September 2025, monthly self-mining revenue is ≈ $51 million.

Cooling improvements reduce power loss by around 8 % and extend rig lifespan by roughly 20 %, keeping breakeven below ≈ $40 000 per BTC – a level that leaves Bitdeer profitable even through moderate market pullbacks.

Financial Pulse

In its Q1 2025 financial report, Bitdeer posted $37.2 million in self-mining revenue and roughly 350 BTC produced that quarter.

While overall earnings dipped year-over-year following the halving, the mining division remained the company’s growth driver and has since accelerated as new capacity came online through mid-2025.

Technology Meets Sustainability

Bitdeer’s sites now resemble high-performance data centers more than traditional mining warehouses. The Rockdale hydro-cooling system, completed in July 2025, significantly improved uptime and power density. In Norway, hydroelectric power covers nearly all operations, supported by ambient cooling. In Bhutan, Bitdeer runs on a 99 % renewable grid.

This renewable mix and energy-efficiency design help Bitdeer manage regulatory scrutiny while aligning with ESG standards increasingly important to institutional investors.

Standing Among Giants

Marathon Digital runs around 31 EH/s, CleanSpark 22 EH/s, and IREN 15 EH/s. Bitdeer’s 35 EH/s – heading toward 40 EH/s – places it squarely among the top global miners by proprietary hashrate.

Its $0.045 /kWh energy cost further reinforces a competitive edge even against larger peers with higher overhead.

Forward Outlook and Strategic Direction

By late 2025, Bitdeer expects to finish deploying the A3 fleet and hit 40 EH/s. Through 2026, additional renewable capacity in Bhutan and Norway should push total hashrate to around 50 EH/s. An A4 ASIC, already in development, aims for sub-11 J/TH efficiency.

If power stays below $0.05 /kWh and efficiency improves to 12 J/TH, Bitdeer can remain profitable even if Bitcoin trades in the mid-$30 k range – a resilience few miners can claim.

CONCLUSION

Bitdeer Technologies’ 2025 performance demonstrates that disciplined growth, low-cost renewable power, and in-house hardware innovation can outperform cyclical headwinds in Bitcoin mining. As the company approaches 40 EH/s and advances toward its 50 EH/s target for 2026, Bitdeer is positioned as one of the most efficient and resilient industrial miners in the post-halving era.

Han su

Han Su is a technical analyst at CryptoMinerBros, a leading provider of cryptocurrency mining hardware. He has over 5 years of experience in the cryptocurrency industry and is an expert in mining hardware, software, and profitability analysis.

Han is responsible for the technical analysis and research on ASIC Mining at Crypto Miner Bros. He also writes in-depth blogs on ASIC mining and cryptocurrency mining, and he has a deep understanding of the technology. His blogs are informative and engaging, and they have helped thousands of people learn about cryptocurrency mining.

He is always looking for new ways to educate people about cryptocurrency, and he is excited to see how the technology continues to develop in the years to come.

In spare time, Han enjoys hiking, camping, and spending time with his family. He is also an avid reader, and he loves to learn about new things.